Securing Success: How Tresorit's Data Rooms Revolutionize Collaboration in Finance

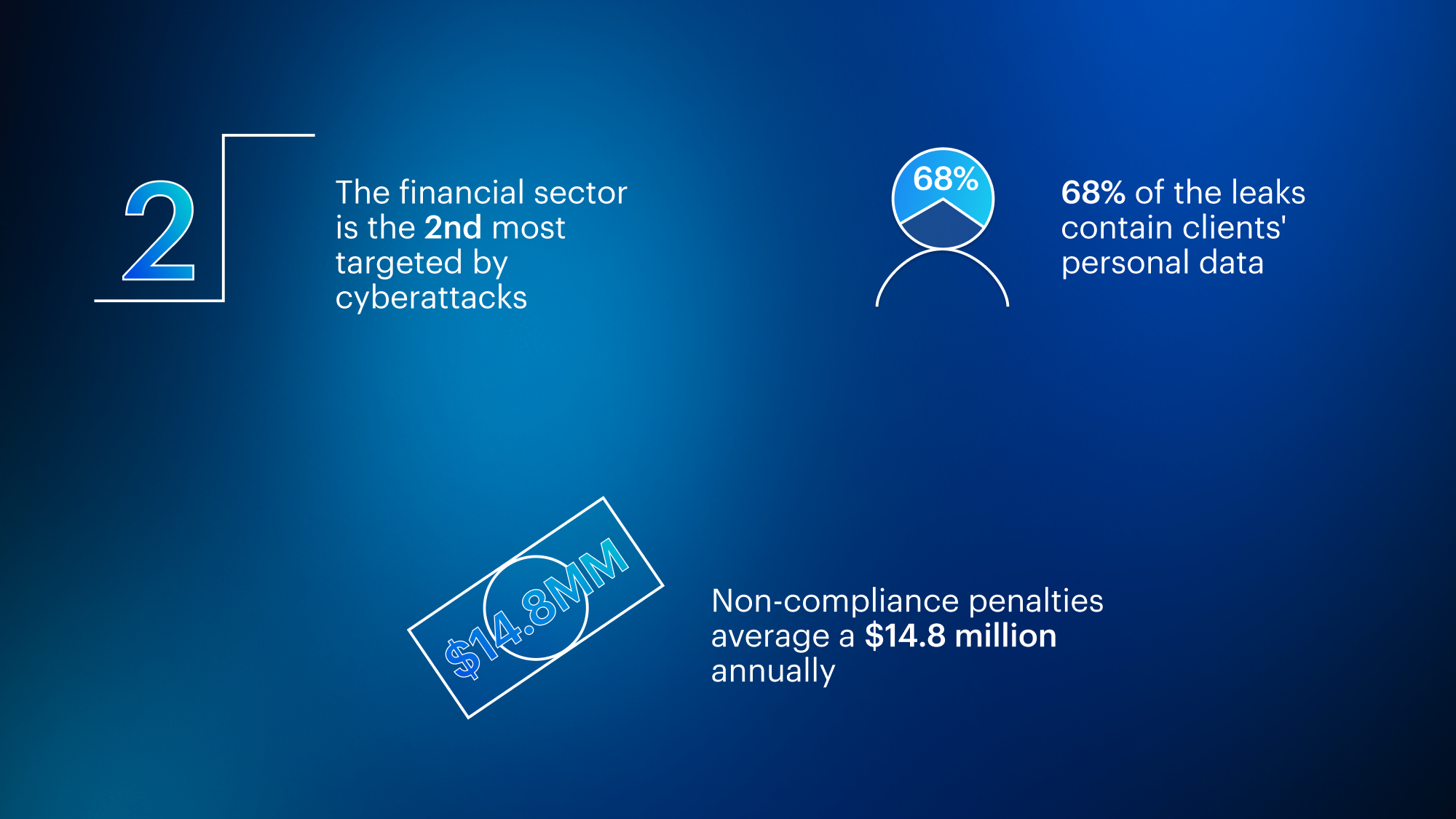

As financial services companies continue their digital journey, sensitive data has become a hot commodity for bad actors. Therefore, secure and efficient data management is critical for success in the finance industry. To date, this sector is the second most targeted by cyberattacks according to IBM’s 2023 data breach report. Financial institutions face average losses of around $5.9 million per cyber incident and most leaks contain clients' personal data and commercial information about organizations.

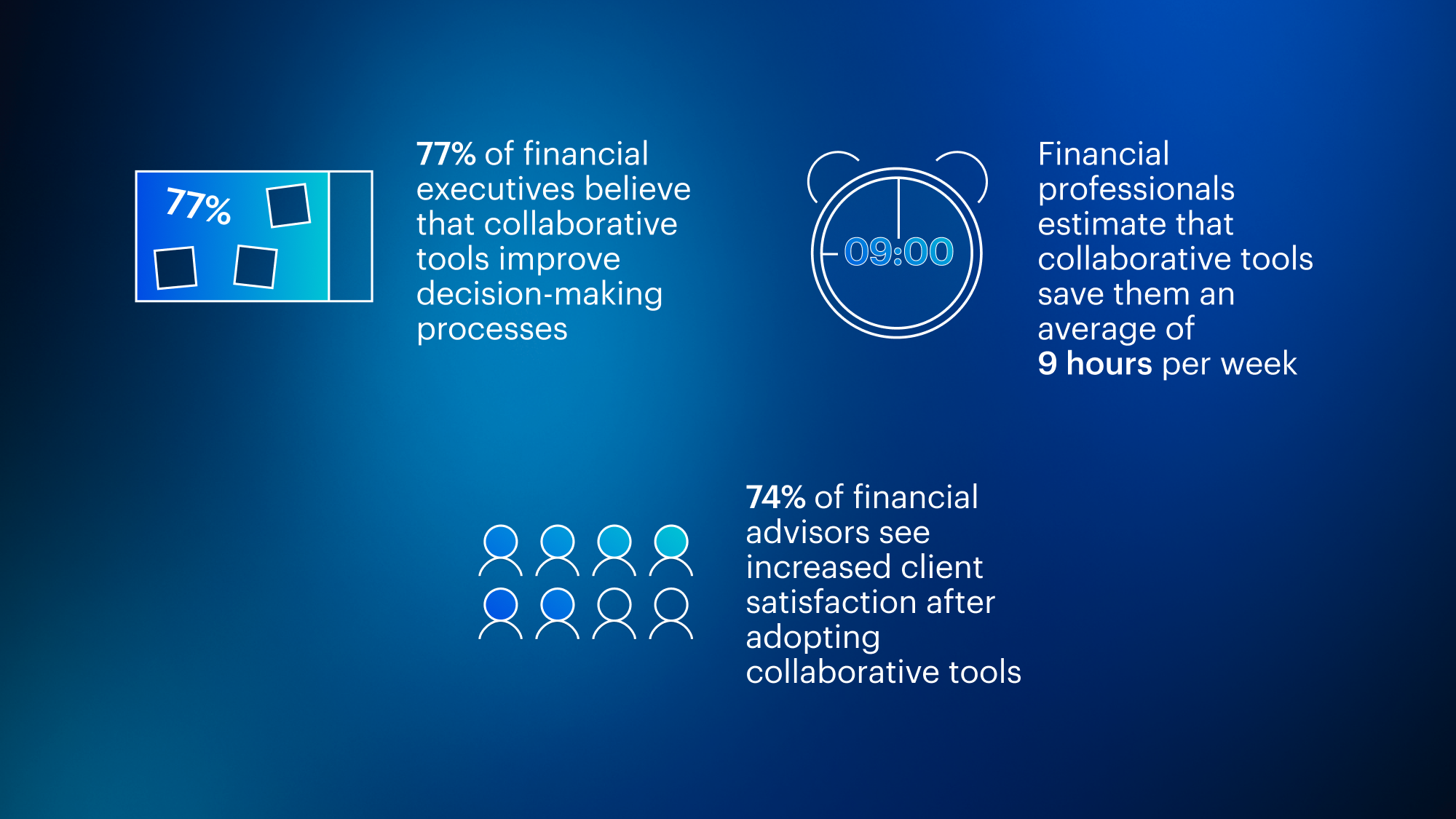

Safeguarding sensitive data in this sector is paramount. But financial institutions also need to adapt to changing working habits, particularly the trend toward remote working. A study by McKinsey & Company found that collaborative tools can improve productivity by up to 25% in financial services firms by streamlining communication, document sharing, and project management processes.

It seems that financial firms face a dual challenge: safeguarding sensitive information while facilitating seamless communication and collaboration among teams, clients, and partners. Tresorit's client and partner data rooms offer a robust solution to address this challenge, providing a secure, efficient, and user-friendly platform tailored to the unique needs of the finance sector.

In our latest webinar we discussed how finance organizations can improve productivity using collaborative tools. If you missed this webinar, you can now watch at your leisure.

Security by design for risk-free transactions:

With cyber threats on the rise, data security is non-negotiable in the finance sector. Tresorit's data rooms offer end-to-end encryption, ensuring that sensitive financial information remains protected from unauthorized access and data breaches at all times.

Regulatory compliance assurance:

Compliance with industry regulations and standards such as GDPR, FINRA, Bafin, MaRisk2 and ISO 27001 is a top priority for financial institutions. Tresorit's data rooms are designed with compliance in mind, providing audit trails, access controls, auto-deletion of shared content, and data residency options to help finance companies meet regulatory requirements effectively.

Streamlined due diligence processes:

Mergers and acquisitions, financing transactions, and regulatory audits require extensive due diligence processes. Tresorit's data rooms streamline these processes by centralizing documents, facilitating secure document sharing and collaboration, and providing granular permissions to control access to sensitive information. Finance professionals can save valuable time and resources while ensuring compliance and confidentiality throughout the due diligence lifecycle.

Enhanced client and partner collaboration:

Building and maintaining client relations is essential in the finance sector where digitally savvy customers increasingly expect mobile-friendly, easy ways for financial interactions. Tresorit's client and partner data rooms empower financial advisors to collaborate seamlessly with clients, providing a secure platform for sharing financial documents, reports, and investment proposals. Real-time sync and file versioning ensure that clients have access to the latest information, fostering trust and transparency in client interactions. All this without training or registration requirements.

Cost Savings and Operational Efficiency:

Switching across platforms is not only time-consuming but can also lead to security risks. Tresorit facilitates friction free interactions within one single platform. Its scanning and e-signature options reduce reliance on paper-based processes, and minimize administrative overhead, leading to significant cost savings and operational efficiency gains.

Unlock the potential of Tresorit’s data rooms for your business

In an increasingly competitive and regulated environment, finance professionals must leverage technology to stay ahead. Data rooms provide a secure, efficient, and collaborative platform for managing critical financial transactions and documents. Using Tresorit, finance professionals can focus on what matters most: delivering value to clients and driving business growth in a rapidly evolving industry.

Embrace the power of partner and client data rooms for your business now.

In the July episode of our ‘Who’s Next’ series, Tresorit’s Head of Product Marketing, Aaron Stillman, will explore, together with privacy specialist Dr Lisa McKee, Founding Partner at American Security and Privacy, the data security challenges faced by the financial industry and how finance organizations can improve productivity using collaborative tools.

You can learn:

- Common pitfalls and challenges to avoid when ensuring data security within the finance industry.

- Strategies for finance professionals to save time and resources while maintaining compliance and confidentiality during the due diligence lifecycle.

- How data rooms can offer a secure, efficient, and collaborative platform for managing crucial financial transactions and documents.

If you missed this webinar, you can now watch at your leisure.